C-level Dataviz Solutions – Turning Data into Operational Impact

Facing scattered data and manual work, COOs look to integrate systems into a single source of truth for faster and more accurate decisions.

In the investment sector, C-level operational leaders stand at one of the most demanding intersections: market pressure, increasingly complex operations, and the need to manage data in a way that enables fast and accurate strategic decisions.

Despite technological progress, many investment firms – from asset and wealth managers to hedge funds, private equity, family offices, fintechs, and corporate investment departments – continue to struggle with fragmented data, rigid processes, organizational silos, and a growing demand for real-time portfolio transparency. In many of these firms, still operating on Excel or outdated systems with an overloaded IT team, the COO’s role is no longer purely operational. It becomes strategic, influence-driven, and focused on connecting data with execution.

This article outlines the key challenges facing COOs in mid and large-scale organizations, their consequences, and practical actions that enable operational modernization and unlock real competitive advantage.

COO as Architect of Strategic Outcomes

The COO’s role in modern investment companies goes far beyond supervising daily operations. It is a pivotal function that translates corporate strategy into specific, measurable results – from optimizing investment processes and building high operational efficiency to creating an environment where errors systematically decrease.

That C-level management operates in a space where data, people, and procedures must form a cohesive, predictable ecosystem that withstands market pressure and regulatory expectations. As the architect of strategic outcomes, the COO designs organizational foundations that ensure continuity, compliance, and process transparency. This enables the firm to operate faster and more efficiently, with structured workflows and operational quality aligned with business ambitions. Below are the most common challenges COOs must address:

Manual Processes – an Operational Burden That Hinders Scale

Challenge

In many investment firms, core operations such as reconciliations, reporting, or month-end close still require extensive manual work. With growing data volumes and multiple information sources, these processes consume massive resources and increase the likelihood of errors. Manual updates, copying reports, and merging data from different systems make operational cycles longer, leaving teams with little time for strategic tasks.

Solution

The priority is to replace manual activities with automated information flows and continuous synchronization within a unified environment. Standardizing data from PMS, accounting, CRM, risk, and compliance enables consistent reporting without manual file merging. Automated reconciliations and reports reduce errors and repetitions, while period-end close becomes faster thanks to continuously updated data that no longer requires laborious adjustments.

Impact on the Business

Reducing manual work significantly eases team workloads, shortens close cycles and NAV/TNA preparation, and improves data reliability. The COO can shift focus from operational firefighting to strategic initiatives that enhance organizational efficiency, accelerate investment decisions, and support scalable growth as assets and fund structures expand.

Data Fragmentation – No Single, Coherent View of the Firm

Challenge

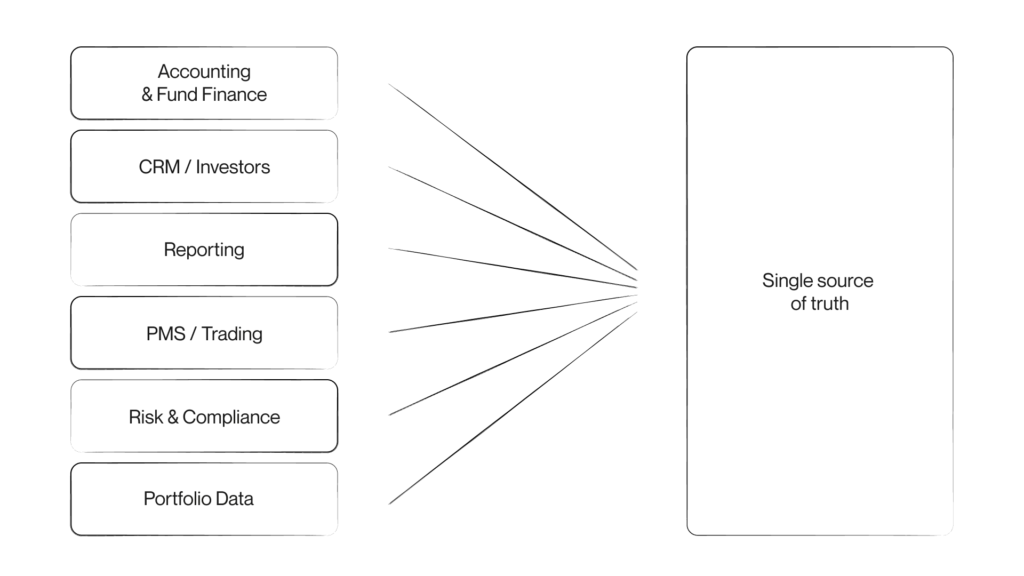

Data dispersed across multiple systems (PMS, accounting, CRM, risk & compliance, reporting, Excel) results in teams working with inconsistent or delayed information. Fragmentation increases the risk of discrepancies, extends analysis time, and hinders fast strategic decision-making.

Solution

Integrating data and consolidating it into a single source of truth eliminates most inconsistencies. Updates occur continuously, and information is presented in standardized sets, ensuring alignment across departments and reducing corrections caused by transmission errors.

Impact on the Business

Eliminating data silos accelerates period closing, improves portfolio analysis, and simplifies regulatory reporting. The firm gains a coherent view of AUM, NAV, cash flow, exposures, and limits, reducing operational and analytical risk and enabling better strategic decisions and competitive advantage.

Weak Communication Between Teams – Information Bottlenecks and Decision Delays

Challenge

Separate systems and the absence of shared tools cause fragmented communication between operations, accounting, trading, risk, and compliance. Data exchanged via email or Excel often does not match, leading to delays, misunderstandings, and inconsistent decisions.

Solution

A unified, automatically updated data environment allows all teams to access the same information simultaneously. Standardized datasets and real-time visibility significantly reduce misunderstandings and shorten reconciliation cycles.

Impact on the Business

Better information flow reduces errors, accelerates decision-making, and improves analytical consistency. The COO gains a predictable collaboration process across operations, accounting, risk, and portfolio management, strengthening the company’s agility and response time to market shifts.

Inconsistent Portfolio Data – Compromised Management and Higher Risk

Challenge

Discrepancies in portfolio metrics (AUM, NAV, cash flow, exposures, limits) create reporting and analytical errors, hinder investment decisions, and delay regulatory submissions.

Solution

A centralized portfolio monitoring system with automatically updated data organized under shared standards ensures consistency and real-time portfolio visibility.

Impact on the Business

Full transparency increases reporting credibility, improves analytical quality, and reduces operational errors. The COO can rely on stable processes, while investment decisions become faster and based on complete information – improving organizational resilience and investor confidence.

Single Source of Truth – Measurably Faster Decision-Making

Research shows that companies that consolidate their data into a single, coherent source of truth achieve tangible operational advantages. According to TDWI, 74% of managers rate the business impact of orderly data as high or very high. In an IDG study, 77% of respondents reported that data visualization optimizes decision-making processes, and 43% observed faster, more reliable ad-hoc analyses as a direct result.

With a unified data source, teams detect anomalies earlier, plan more precisely, and collaborate more easily across departments. The time from receiving information to acting on it – time to insight is significantly reduced. Clear, consolidated data visualization enables managers and analysts to act faster, smarter, and more strategically.

Conclusion – Data Presentation as the Key Differentiator

Data quality is essential, but the true advantage lies not in the numbers themselves, but in how they are organized and presented. Firms that see their data clearly react to risks faster, allocate resources more efficiently, and respond better to changing market conditions.

Discover practical approaches to data presentation and shortening decision-making processes here.